TVO Market Barometer 2-2: You can’t win ’em all… or can you?

A local newscaster up here in Boston just said, “We’re so used to seeing the Patriots winning, it’s hard to believe they lost.” Sound familiar? If you’ve been paying attention to the sudden fall of this year’s bull market rally over that past week, well, it should ring a bell. The more you get used to something, the harder it is to let go.

Granted, we’re talking about a single team as opposed to millions of traders and investors out there, but the concept is still basically the same. Even after an incredible run (5 wins out of the last 8 times is quite a stat even for a trader), all things must come to an end and you just can’t win ’em all.

Or can you?

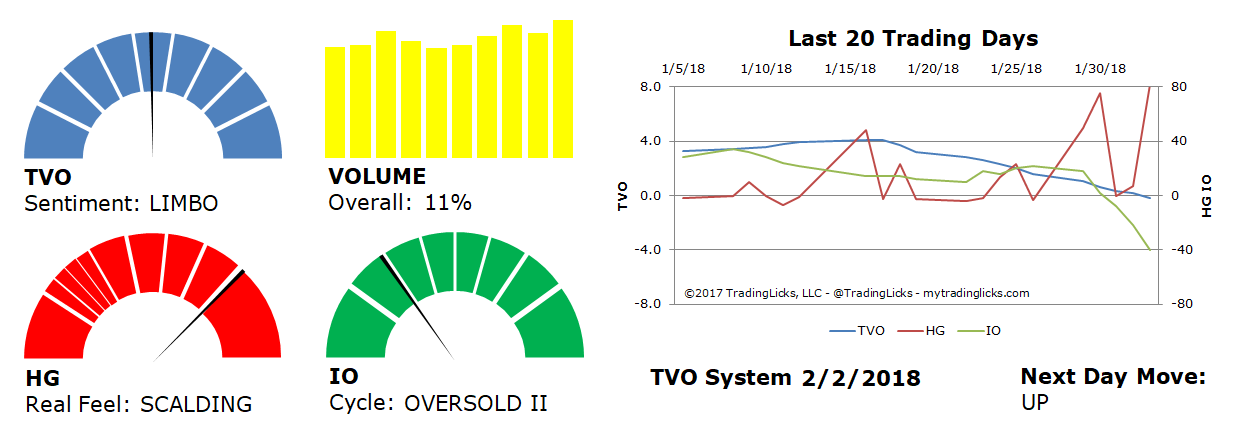

Anyone who has studied markets and understands the concept of mean reversion is kidding themselves if they think we won’t get some kind of a bounce soon. Our Heat Gauge is just about maxed out at a SCALDING 82, and IO, our Issues Oscillator, has quickly dropped into the OVERSOLD II category. And while we focus primarily on our own indicators, it’s also worthy to note the McClellan is at level where reversals are imminent, and SPY has perfectly landed at the 50% retracement of the January run up.

And yet, so many folks are in hard denial as if the long deserved retribution is finally at hand. Perhaps they’re so used to seeing the other side win that when they finally get their day, they turn a blind eye to reason. And who can blame them? After all, who doesn’t enjoy watching the underdog win once in a while? (Well, aside from a few of my neighbors around here)

But being a successful trader is really not about winning. It’s about using your resources to come up with an approach that gives you an edge to trade the market. Do that enough times consistently and you’ll always come out ahead. In that way, you really can “win ’em all” as long as you stay in the game. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.