TVO Market Barometer 12-19: Is this a bear market or a buying opportunity?

The Fed spoke and markets came crashing down for what may finally be the biggest buying opportunity of the year. Only problem is, very few have any cash left to buy, as this market has been slowly eroding what remains of the MAGA rally, now just a distant memory.

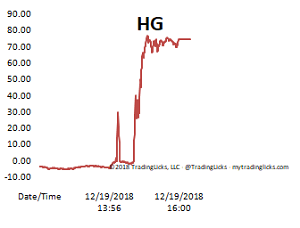

On the volume side of things, though, it was starting look like the worst fears were in the rear view mirror, but suddenly in just this past week, the distribution days have finally started to rack up. The one bit of good news for the bulls is that Wednesday’s high volume flush from the Fed is likely to fuel a hefty oversold bounce… that is if there’s anyone still here to trade it as holiday travel plans start to kick in.

Our TVO System as a whole is currently down around 10% for 2018, however, Next Day Move by itself, which was introduced at the end of last year, is actually up around +3%. When a system that has produced positive returns for the past 20 years (16 in backtesting and 4 in actual trading) takes a pause, it could very well be that long-term strategies in general (well, anything longer than a day or two, that is) have also taken a hit this year. And this premise seems to be confirmed by the many tweets and blog posts I’ve come across from my fellow traders out there.

Now before all the young “padawan” traders reading this start thinking about swapping your swing shoes for a pair of fast day trading sneakers, consider this: the kind of environment where day trading reigns supreme is ultimately a temporary one (remember 2011 and 2015, anyone?). And the minute you’re just getting used to your new “stare at the screens all day” lifestyle, swing trading will once again return in all it’s glory without you in it.

But don’t worry, the market will always be right here when you’re ready to come back. -MD

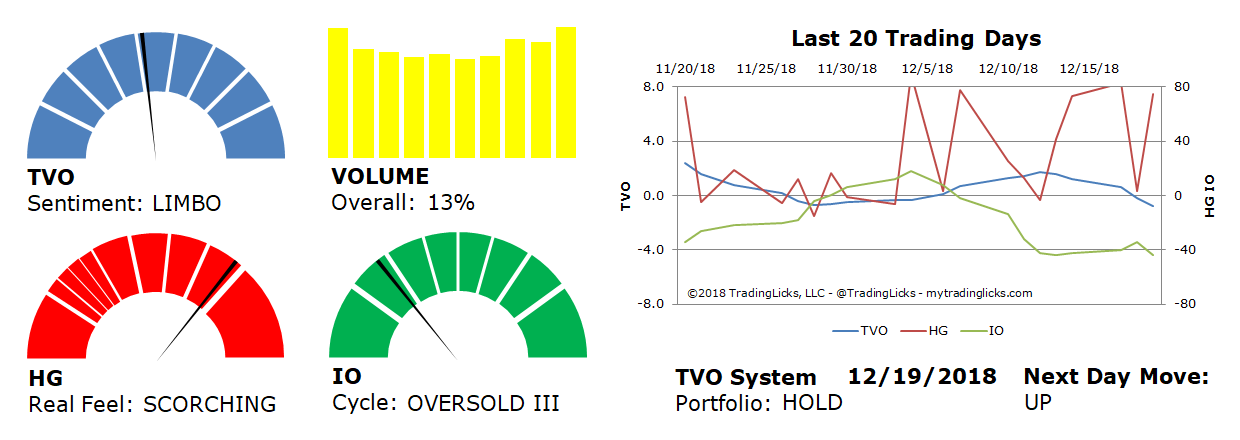

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 13% – Today’s volume was higher than the previous session.

Real Feel: SCORCHING – Bears dominated the session with a minuscule amount of buying under the surface.

Cycle: OVERSOLD III – Retail investors are running for the hills.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 60%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.