TVO Market Barometer 11-15: What is really driving this market?

For SPY traders, the one helpful thing to remember, especially if you’re long and you want to preserve your sanity, is that no shake-out is complete until all gaps are filled. And now that market makers have complied with their “no gap left behind” policy (because, after all, the gaps are where all the stop orders are), the market can now resume its default direction of “UP”.

From a volume perspective, however, Thursday’s reversal was not all about gap filling. For the past week as prices declined, so did volume, leaving very little in the way of distribution (some on the big board, but pretty much non-existent on the Nasdaq).

And then there’s the famous “Inverse Head and Shoulders” pattern across the indices that everyone who’s ever used a charting program is talking about. Most folks generally see what they want to see when it comes to patterns, but when everyone sees it (including bulls, bears, news pundits, grandmothers, etc.), well, let’s just say I wouldn’t want to be shorting the other end of that self-fulfilling prophecy.

The basis of our core philosophy, though, is the idea that volume, or lack thereof, is what drives the market, not price or charts. In that way, all our trades (including the one we closed on Thursday that resulted in a +22% gain) are based solely on factors related to volume… but the “IHnS” is still fun and somewhat relevant to look at nonetheless.

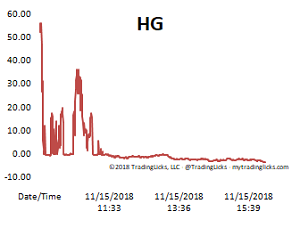

As far as volume right now, TVO, our volume oscillator, is at a level where big institutions are well into accumulation mode, they just don’t know it yet. Volume may not appear as clear or as obvious as a pattern on a chart, but once the vacuum starts getting filled, it’s only a matter of time before price follows suit. -MD

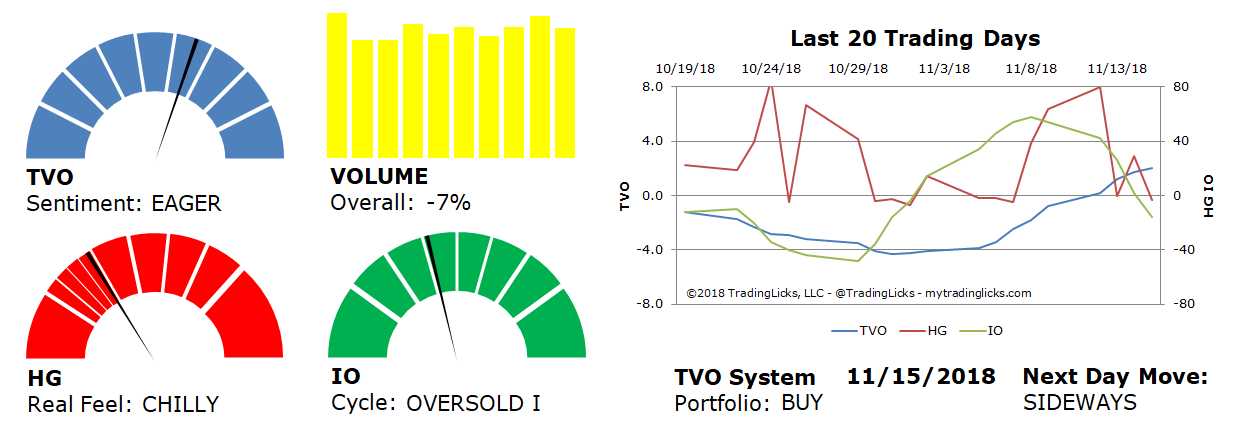

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: -7% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.