TVO Market Barometer 10-04: How do you know when to sell?

Part 2 of the “Presidential Alert” shake-out transpired on Thursday, and the scene followed the classic Wall Street script to a T. It all starts with a big accumulation day, followed soon thereafter by a low volume sell-off to sweep the stops.

All that’s left is the massive buy-back, which looks to have already started late in Thursday’s session. The Nasdaq did log some distribution, but volume actually fell on the big board, so apparently the smart money players took the move in stride while retail folks were busy running for the hills.

We sold some of our calls today for a 22% loss, but escaped what could have been much further damage by waiting until the close to exit. Now as much as I’d like to attribute the timing of the trade to my keen tape reading skills, I just simply can’t take the credit. The decision was based purely on probability and a rules based system. Anything else that remotely resembles skill is simply dismissed as fiction.

When put to the test, our whole methodology during a shake-out usually comes down to 2 choices:

- Stick to your trading plan.

- Give in to panic and sell at the low of the day.

Because of the experience of latter, there are strict sell rules that we follow with NO exceptions.

You might be tempted into thinking that you can outsmart the market (or your own system) and sell intraday or use some kind of fancy stop orders or options spreads for “protection”. And you just might be able to make that work in your favor once in a while. But when you have the confidence of extensive backtesting and years of positive returns from live trading to back up the sell rules you’ve created, there’s just no point in giving in to the temptation.

Yet, many experienced traders do give in to just that, time and time again. When emotions take control, even many years of honed skills are no match for “fight or flight”. It inevitably becomes apparent that you can’t fight the market, and that’s when the above choice #2 is made.

Knowing the probability of the outcome, removes any bias (no matter how many times you’ve seen the market reverse, what you’ll remember the most is the time it didn’t), and allows you to think rationally. Choose to establish a set of rules now and follow them to a T, so when next big shake-out comes, you won’t have to make a choice. -MD

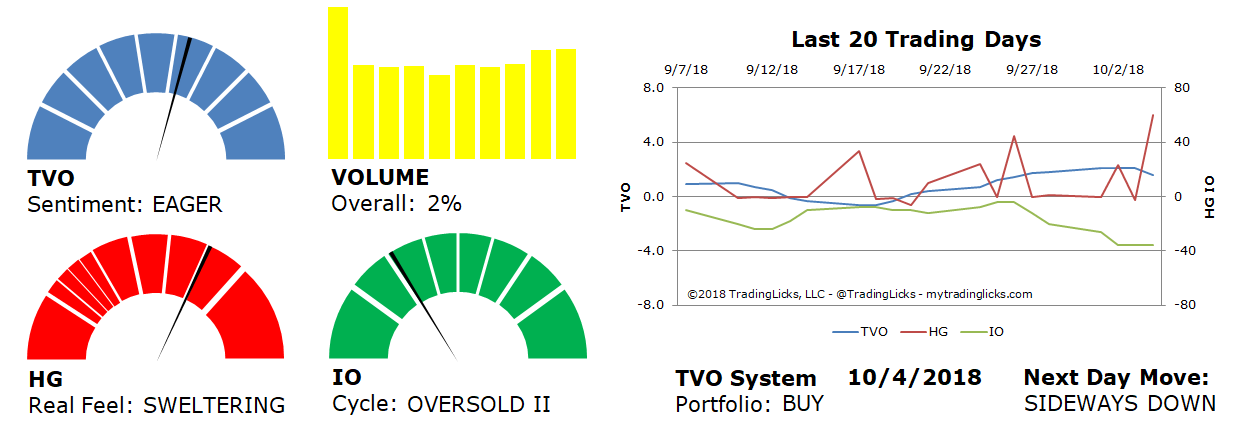

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 2% – Today’s volume was higher than the previous session.

Real Feel: SWELTERING – Bears were in control of the session with a slight trace of buying under the surface.

Cycle: OVERSOLD II – Retail investors are dumbfounded and are rapidly exiting their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.