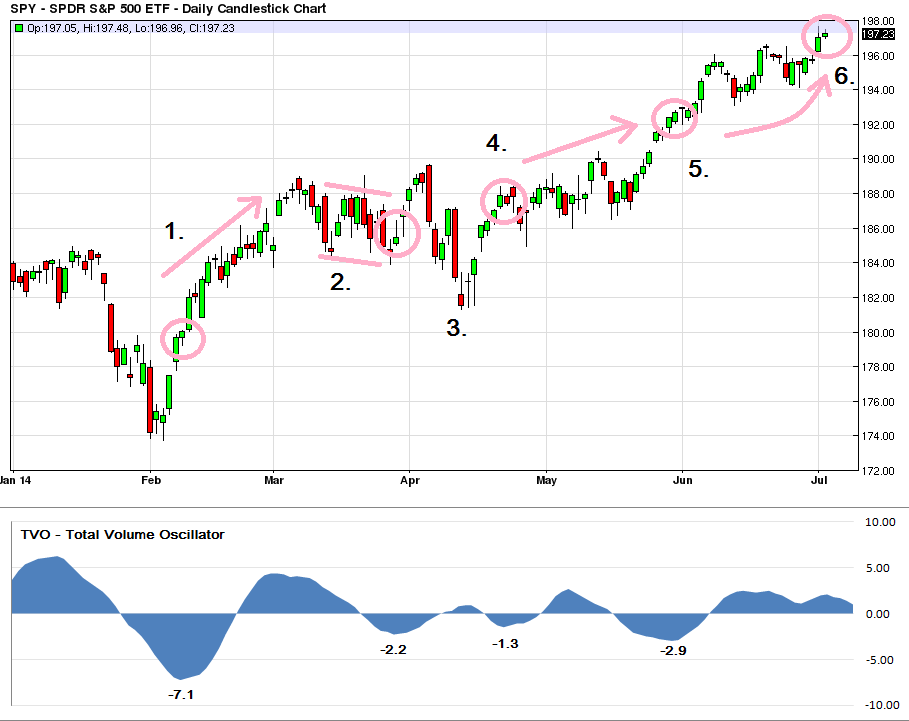

TVO 2014 – Year in Review Part 2

The TVO System signals generated 6 trades in 2014 achieving an 83% win rate (5 out of 6). As a result our options account nearly doubled (73%), and no more than 10% of capital was put at risk at any given time. How did we do it? We’ll be posting an in-depth analysis of each of the trades. Here are 2 back to back long trades that took us from February into July.

1. On Friday 2/7/14 the Oscillator reverses to -7.1 giving us a buy signal. On Monday’s close (2/10/14) we buy SPY May-14 calls at 5.76, (also selling our puts from the previous short trade) just in time for a nice bounce to take us to new highs.

2. Volatility picked up and SPY consolidates for a few weeks in a 4 point range. TVO reverses again to -2.2 and gives us another long signal, so on 3/28 we buy more May-14 calls this time for 5.57.

3. SPY breaks the range and then suddenly goes south in a big way. After all the stops are taken out just below the SPY 184 level (an area of previous resistance), the market reverses. We don’t use stops (precisely for this reason), so we’re still in the trade.

4. To lessen the time decay of options, our timed exit takes us out on 4/22 and we sell our calls at 7.52 for a 33% profit.

…But wait, there’s more. TVO reverses to -1.3 so the next day we are long again with SPY Aug-14 calls at 5.07.

5. Another TVO reversal at -2.9 and we add more calls, this time averaging up.

6. Our timed exit takes us out again on 7/2, selling the calls at 9.24 for a 73% gain. -MD

Read about more 2014 TVO trades in Part 1 and Part 3.

For more on market volume, The TVO System, or how to trade options follow me on Twitter (@TradingLicks) and StockTwits!

Performance results on this website dated prior to September 2014 for TVO (prior to May 2015 for HG), including backtesting and trade history, are simulated. Please read our full disclaimer.