Trading Taking A Hit? Look At The Big Picture. Weekly Market Volume Outlook.

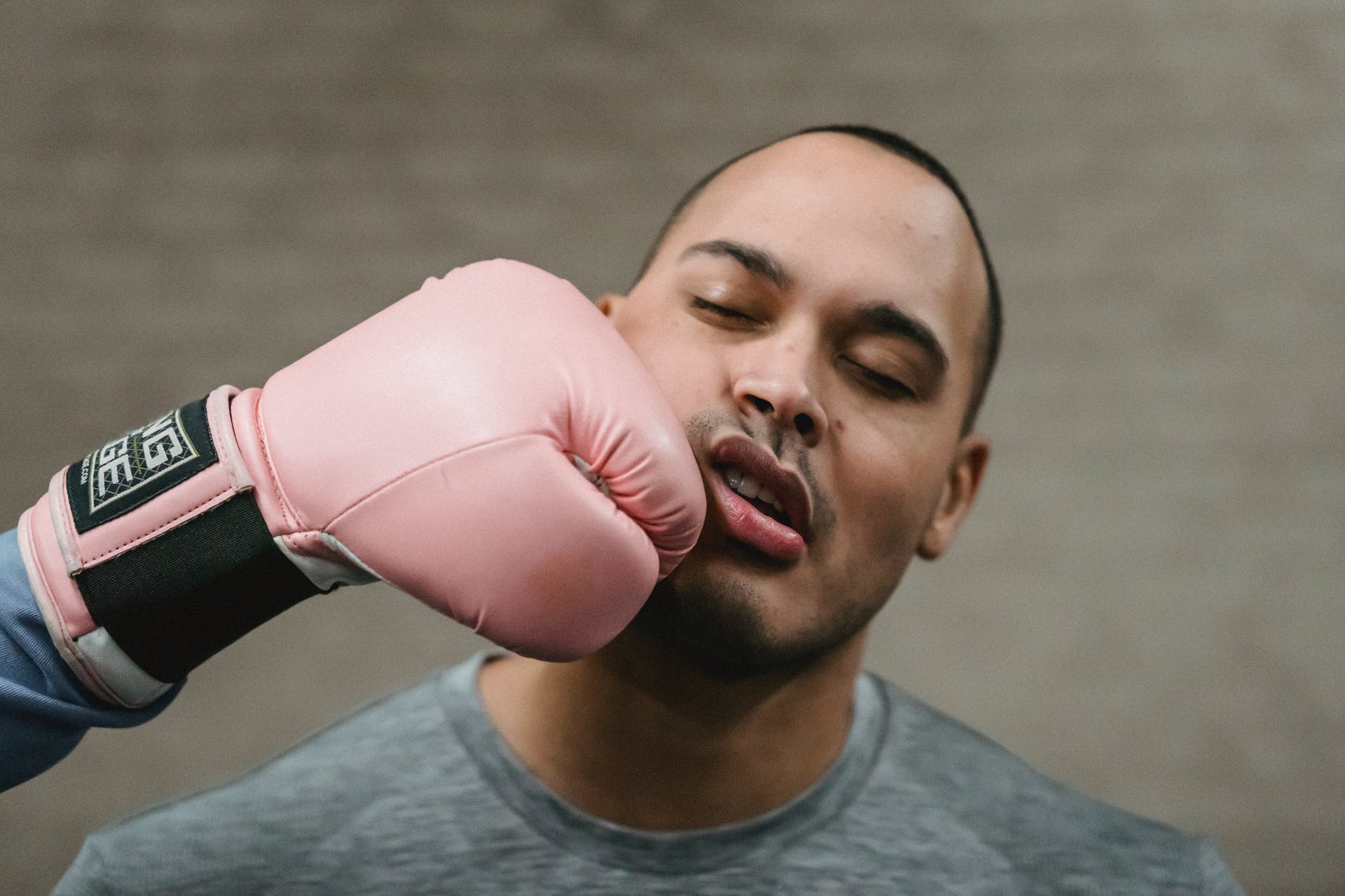

Markets continued it’s 2 week rise on Tuesday with overall volume jumping 18%. This was the 3rd across-the-board accumulation day we’ve seen since mid march (3/16, 3/18 and today, 3/29). You could say the Fed announcement was the fuel behind this rally, but in reality these kind of events are just catalysts for what’s already brewing under the surface. For example, you probably wouldn’t spontaneously slap someone in front of all your friends just because of a dumb joke unless there was some far deeper problem bothering you… but I digress.

In trading, we strive to position ourselves before these catalysts occur, because in most cases if you wait, you’ll end up missing a good part of the move. Back on March 9, TVO reversed towards positive values, and we did exactly that. The ride started off bumpy, but we got in a good 10 points below the subsequent SPY close a few days later on Fed day, and now our SPY 427 calls are up +97%. After a pretty rough start to 2022, we’ve already regained a good 1/3 of our losses so far.

How are we able to stay focused on our trading strategy after a such a big drawdown? By never losing sight of the big picture. Even though our win rate has taken a serious hit this year, our overall 2 year winning percent is still at 65%. And we also have the added confidence through back testing from a 65% win rate over the past 16 year period, as well as a greater than 1 to 1 historical payoff ratio.

This means the winners outweigh the losers, with the trade we’re currently in being a prime example. Since 2014, it’s been pretty typical for TVO to produce at least one round trip trade a year exceeding a +100% gain. It’s this continued success of our original algorithm that keeps our system on track over the longer term and in the years to come.

But isn’t the market extremely overbought right now? Well, as always, it depends on your time frame. In the short term, a shakeout is surely a possibility. In the longer term, however, our TVO oscillator has just risen above zero which is a LONG or buy signal for portfolio investments. The range of 0-3 on TVO has shown to be a “healthy market” indicator and a good time for opening or adding to long term stock positions.

Catalysts, though, like the jobs report this Friday for example, are inevitable. But with institutional support this solid, even if it gets hit in the face, the market already knows it’s best to keep calm and continue on with the show. – MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!