Mind the gaps before boarding the train. – TVO MB 2-15

Last Friday was an impressive day for the S&P 500 price-wise. As far as volume, though, it was the Nasdaq, and not the S&P, that managed to log an accumulation day.

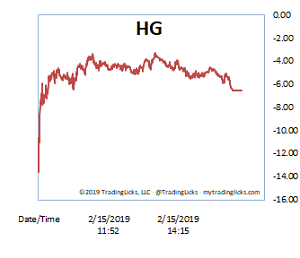

The Heat Gauge was solidly in FRIGID territory for most of the session. It doesn’t take tremendous tape reading skills to see that this is very bullish tape with SPY 280 as the destination.

The 2 things the bears do have going for them are 2 unfilled gaps below at SPY 272 and 276. Along with death and taxes, the one other thing you can be sure of is that all gaps eventually get filled. The key word here is eventually, which implies a long time, but it can also happen tomorrow or as soon as Wednesday’s Fed announcement. -MD

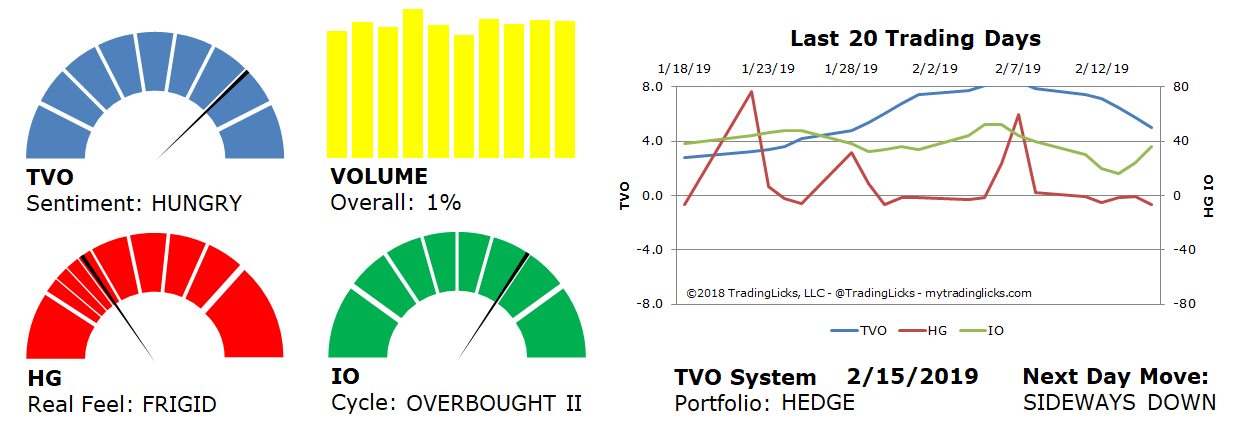

Sentiment: HUNGRY – Markets are accumulating at an accelerated rate and big institutional buying is heavy and aggressive.

Volume: 1% – Today’s volume was higher than the previous session.

Real Feel: FRIGID – Bulls were in control of the session with a fair amount of selling under the surface.

Cycle: OVERBOUGHT II – Retail investors are overly cocky and heavily positioned in their holdings.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.