Markets finally got their “lift.” Now what? – TVO MB 4-02

After last Friday’s accumulation day, this week the markets finally got the “lift” the bulls have been waiting for (which probably has nothing to do with the Lyft IPO, but who knows). Overall volume has been on a decline, though, over the last 2 sessions, but that’s not completely unexpected after an end-of-quarter volume rise of 19%.

We took advantage of Monday’s pop and sold our SPY calls from 3/22 for a +38% gain. This brings our account YTD return to +19%, picking up right where we left off in November of 2018 (putting December’s rout firmly in the outlier category). Even so, drawdown is a fact of every trading system, but with TVO it doesn’t last very long.

Our concept of swing trading is simple enough: buy at weakness or the low of the swing, and sell at strength or the top of the swing. It’s something that occurs over and over again in all types of markets, yet it still amazes me when I hear folks say how they just can’t wait to short the swing low.

Well, what about shorting the swing high, then?

Interestingly enough, if you choose to do that, be aware that historical odds are not in your favor. The market by nature is designed to go up, otherwise what’s the point of it all anyway? If you’re the type of trader who is dead set on trading against the odds and nature (and you still have capital left), you may want re-think your life while you still have a chance.

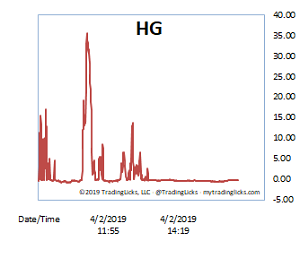

The large down volume spikes on the Heat Gauge today show that big institutions are ready and willing to take advantage of any uncharacteristic pop (review the post of when bears become bulls) that suddenly comes their way. Whether it’s enough to fill the gap below (and potentially another one on Wednesday), remains to be seen, but be aware that in a FOMO charged market, gaps can and will stay unfilled a lot longer than you’d ever expect. -MD

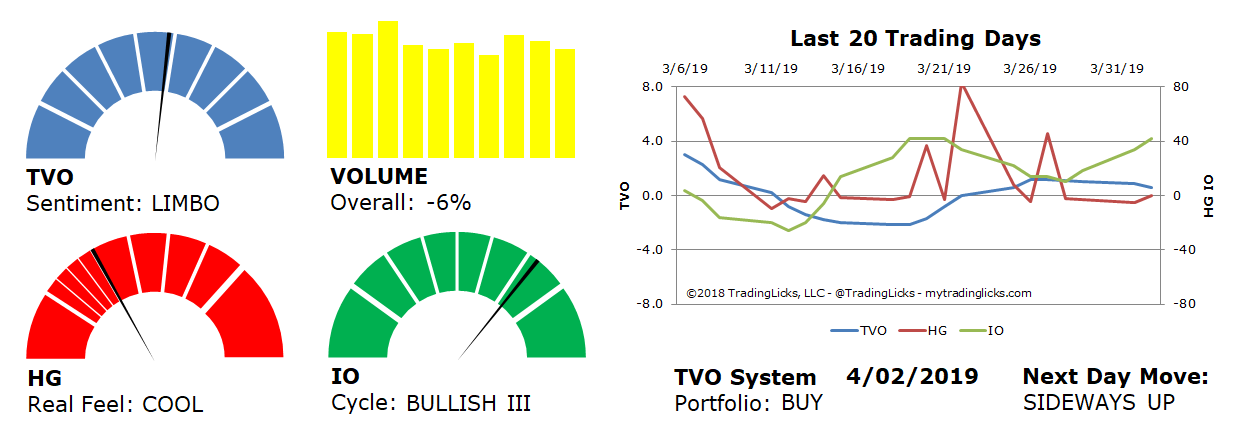

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -6% – Today’s volume was lower than the previous session.

Real Feel: COOL – Bulls and bears were at a stalemate for the session.

Cycle: BULLISH III – Retail investors have bitten off way more than they can chew.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS UP – The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.