Is This A Short-Term Bottom Or Another Gap To Fill?

First I’d like to say congrats to the bears who made money today. Shorting the dip is not easy. It goes against the trend and the odds, and not many have the temperament to do it.

If you’re a bull and took losses today (like me), you can seek comfort in knowing that you’re in good company. Anyone of the great investors or traders who ever made a fortune in the market (Buffet, Templeton, Tudor-Jones, Livermore, Berry… the list goes on and on) will be the first to tell you that taking losses was an integral part of their process.

If you don’t learn how to take losses in a methodical, non-emotional manner, you will have a very hard time sticking it out long enough to make any substantial gain in the stock market. No one has ever done it any other way, and if they say otherwise, well, they’re just plain full of it. Period.

Ok, moving on today’s volume…

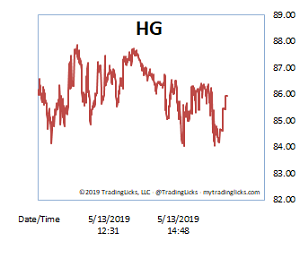

Markets literally fell off a cliff on Monday as the tariff war rages on. Just like last Tuesday, institutions showed their hand and logged another across-the-board distribution day. The Heat Gauge was firmly at SCALDING the entire session (about as hot as it gets), without getting any better or much worse as the day went on.

Does this mean that we’ve established a short term bottom? Well, technically in the bear’s favor, there’s an unfilled gap at SPY 275 and we’re only 3 points away from the 200 day moving average. But beyond pure speculation, the odds of those points being tested is virtually impossible to know.

We do know that all gaps do get filled (but not always) and we know that moving averages are lagging indicators that often “catch up” to the prices they underline. What we also know, according to decades of continuously adapting volume data, is that the chance of the market going up after a SCALDING day is 55%. That might sound like odds that are only a little bit better than a coin toss, but faced between pure speculation and well documented historical probability, I’ll take the odds hands down every time. -MD

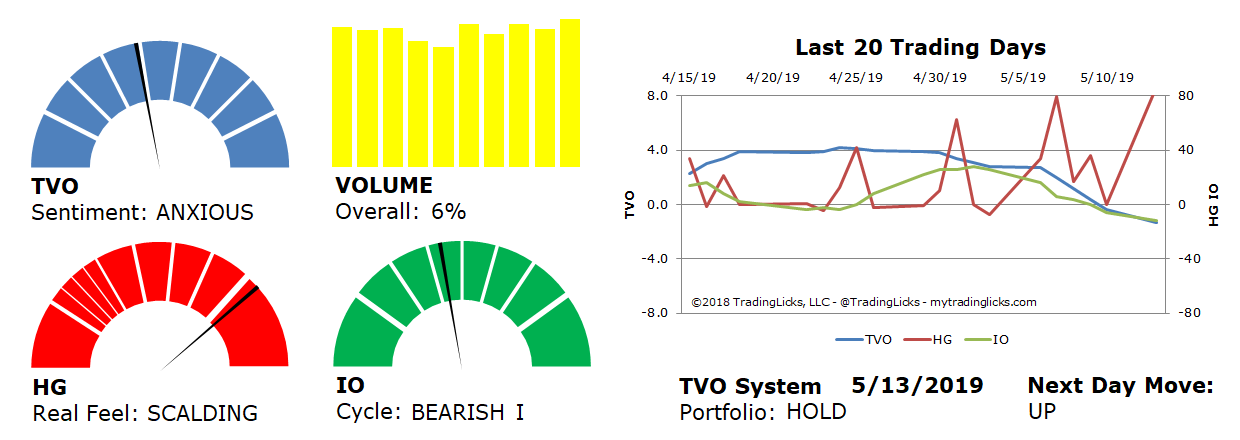

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 6% – Today’s volume was higher than the previous session.

Real Feel: SCALDING – Bears dominated the session and buying was practically non-existent.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 55%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.