In trading, some laws were made to be broken. – TVO MB 3-20

According to Newton, for every action, there is an equal and opposite reaction. In trading this is often seen as “buy the rumor, sell the news.”

On Wall Street, however, the laws of physics don’t always seem to apply.

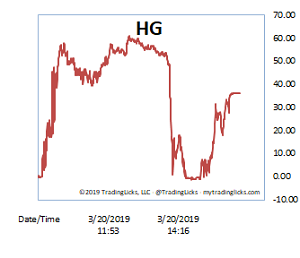

Before the Fed announcement, Wednesday’s session started out as sell the rumor, then buy the news, and finally sell the news. If that sounds confusing to you, well, now you know the reason why I focus entirely on volume when it comes to making trading decisions. Our Heat Gauge ended the session rather hot and TORRID and that’s all we need to know.

Looking at the selloff in the indices today, only the Nasdaq crossed over into the volume distribution category… which is interesting as yesterday’s rise gave it what it needed to slip it into accumulation territory.

What’s going on?

Well, the shake-up before the break-down, fake-out before the break-out, break-out before the shake-out (among many others) are just a few “cause and effect” laws of trading that come to mind as possible scenarios. Whichever you choose, trade them wisely and expect the laws to be broken often. -MD

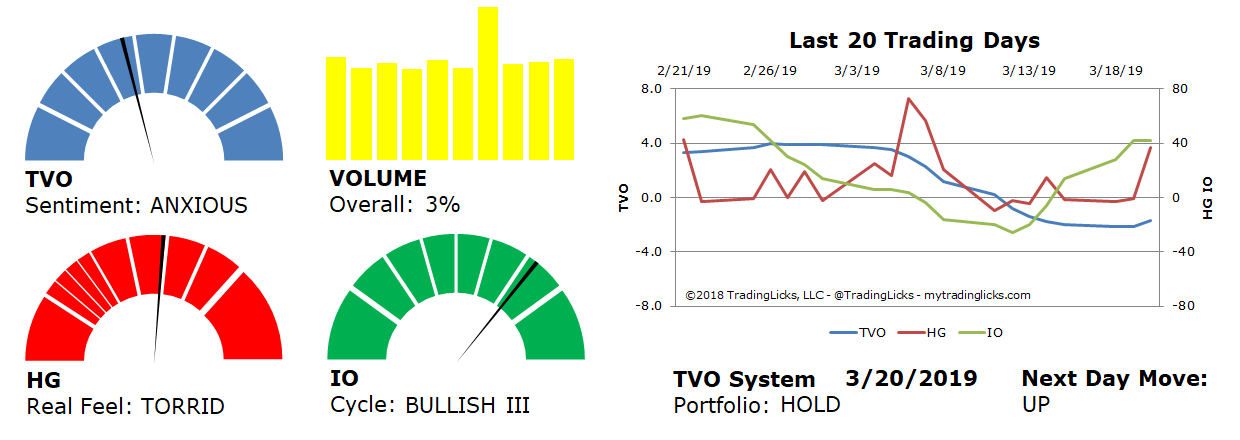

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 3% – Today’s volume was higher than the previous session.

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: BULLISH III – Retail investors have bitten off way more than they can chew.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.