Gaps get filled but volume is not that fussy. – TVO MB 3-25

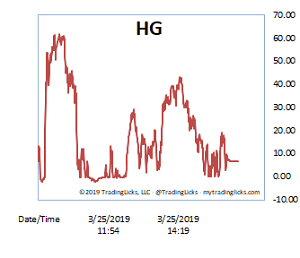

If you take away the recent recession fears from the media, the job of last 2 sessions was to fill the gaps on SPY (280 and 278) and nothing more. It was a classic shake-out as they say. And after the weak hands had all jumped ship (represented by 2 large spikes on our Heat Gauge), the day finished off slightly BALMY with advancing and declining volume just about even.

But isn’t today’s low overall volume something for the bulls to watch out for? Well, no not really because the real action happened last Friday when volume jumped almost 10%.

For all of those folks with your eye on whether your favorite stock or index hits that prior support/resistance level to the penny at just the right time, well, I have to tell you… volume is just not that fussy. Out of the 2 or 3 days it takes for a reversal to take hold, the big volume that counts can happen on any one of those days, not necessarily the swing low.

Meanwhile, our portfolio approach has just shifted to BUY mode, and it’s quite possible that another market accumulation phase is now getting underway. -MD

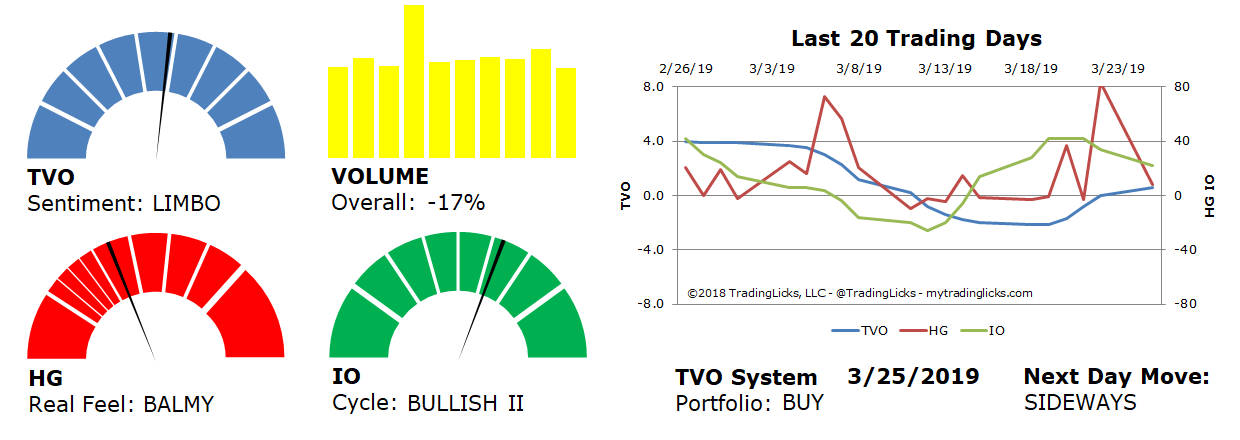

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -17% – Today’s volume was lower than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: BULLISH II – Retail investors are overly cocky and heavily positioned in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS – The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.