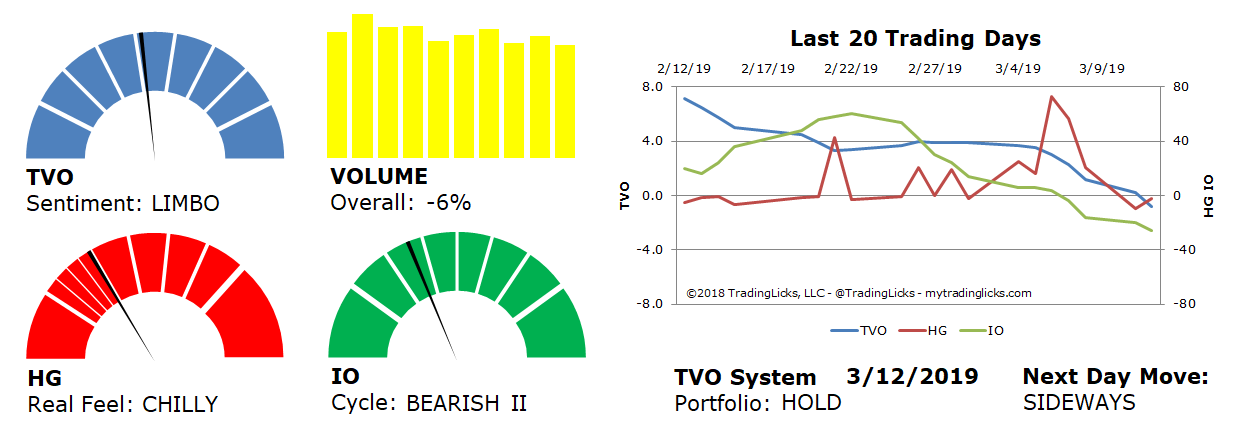

Another gap, low volume and SPY ex-div. What’s next? – TVO MB 3-12

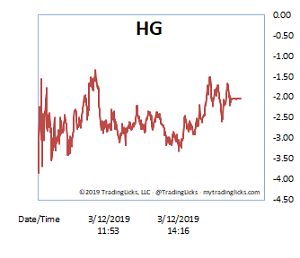

On Tuesday SPY opened with a gap and despite the 282 hopes (from both bull and bear camps), intraday price action didn’t make much progress. The Heat Gauge did stay in the CHILLY range for the entire session, so the bulls are still behind the wheel of this current bounce off the 50 day MA. Overall volume did decline, but it’s only natural for markets to take a breather after Monday’s decisive high volume rise.

The gap count has now risen to 3, and with SPY ex-dividend coming up, the bears will be almost certain to fill at least one of them. The 8 to 10 point range that’s forming may offer some decent reward/risk short-term, but this may not be the best time to set sights on anything monumental in either direction. By the way, keep in mind that if you plan to short SPY on Thursday to cash in on the dollar or so drop, you will owe the dividend amount per share when you cover. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -6% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: BEARISH II – Retail investors are dumbfounded and are rapidly exiting their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS – The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.