Was SPY 276 our last gap? No, there is another. TVO MB 3-07

Overall volume continued to rise on Thursday, as the market racked up its second day in a row of across-the-board distribution. There are some bulls, though, who are celebrating what seems to be a successful retest and bounce off the S&P 500’s 200 day MA.

Now that we got the retest out of the way, it’s all up hill from here, right? Well, as I’ve mentioned here many times before, there are few things that are certain in life, and gaps getting filled is one of them.

But didn’t we already fill the one at SPY 276? Yes indeed, but there is another one at 272, and this one contains a lot of trapped and angry bears hungry for vengeance.

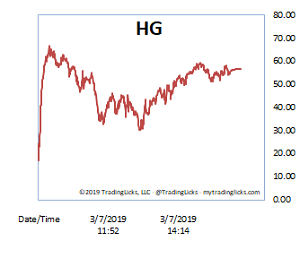

Don’t get me wrong. Today’s drop did have buyers, and it will likely take more than Draghi to turn this market over to the dark side in the longer term. With HG at SWELTERING and more heat to spare at the top of the scale, though, this retest may have a flush or two in store before all is said and done. -MD

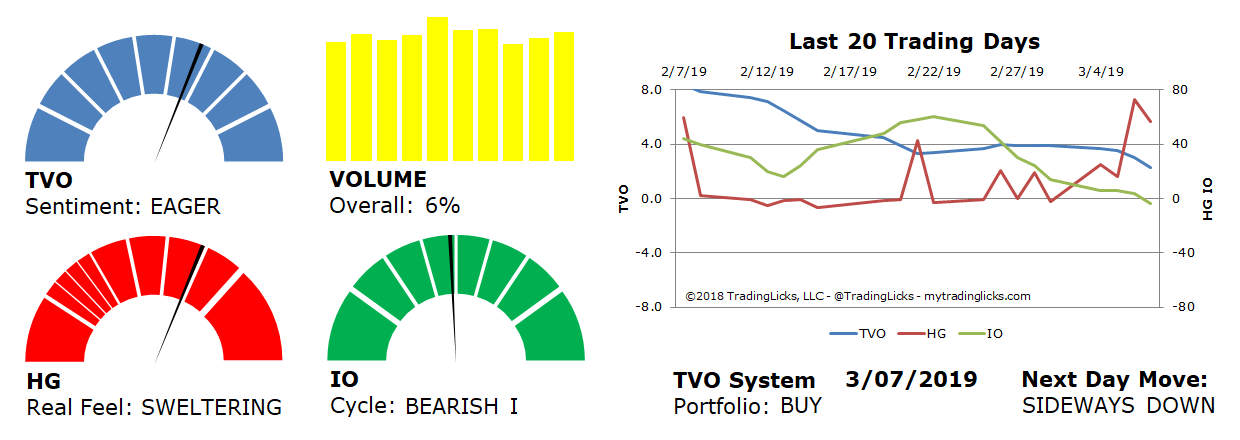

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 6% – Today’s volume was higher than the previous session.

Real Feel: SWELTERING – Bears were in control of the session with a slight trace of buying under the surface.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS DOWN – The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.