TVO Market Barometer 11-07: America has spoken, now what?

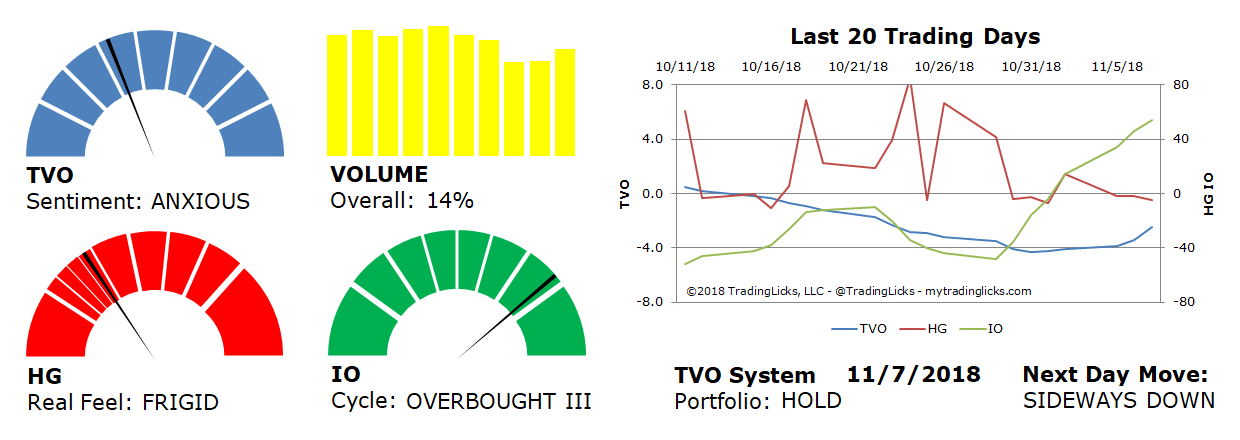

Overall volume swelled 14% on Wednesday, the day after the American voters finally got their voices heard. And the market was apparently listening to those voices as institutional buying was heavy across the board (short covering can only pump up things so far).

As mentioned in the last post, the “market will drop if the Dems win” crowd had plenty of time to fly the coop before the election, so now that it’s over we can all get back to our regular program of run-up, shake-out and buy-back… which means that the shake-out may be on tap (especially with the Fed meeting) for the next few days.

TVO is now quickly and decisively heading back towards positive values, which is a reversal move in volume that we always look out for. We noticed it shifting close to the end of last month and were able to position ourselves well before the post-election bump. October knocked our account into the red for 2018, but last week’s SPY calls (now up +40%) have already put us back in the black for the year.

For the next week or so, here are a few technical points to consider:

1. Markets are now OVERBOUGHT, but there is such a thing as a correction of time rather than price.

2. Every chart is bearish until it isn’t, which basically means it’s all in the eyes of the beholder.

3. Moving averages and trend lines often become “lines that move” when price movement doesn’t go as planned.

4. By the time you’re done complaining about low average daily volume after a period of high volatility, the market will be well on the way to all time highs without you in it. -MD

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 14% – Today’s volume was higher than the previous session.

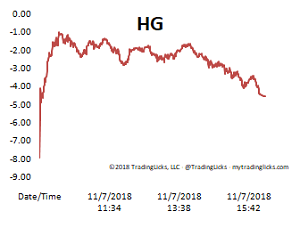

Real Feel: FRIGID – Bulls were in control of the session with a fair amount of selling under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.