TVO Market Barometer 10-19: A surprise pop or terrifying drop?

This October is certainly living up to its reputation as the scariest month of the year so far. You’ve got the mid-term term elections coming up (with potential outcomes looking equally terrifying on both sides of the aisle), and there’s also the precipitous drop in the stock market that has everyone spooked.

After the initial plunge, the bulls did get a “bigger than a dead cat” bounce off the 200 day MA on most of the indices. The cat didn’t quite make it out of the bag, though, as the rally was rejected and sent prices plummeting right back down to the 200.

From a volume perspective, bears currently have the upper hand with a good number of distribution days under their belt. Despite the price action and the battle cries from the “buy the dip is dead” crowd out there, volume and internals are showing some buying, and maybe even a bit more than what you’d expected from the usual 200 day MA algos.

TVO, our long-term oscillator, is steadily descending and still has some room to fall, so big institutions have not wholeheartedly committed to the reversal at this point. On the other hand, IO, which tracks retail investor sentiment, is quickly climbing, so we may see higher before we see lower… which may or may not include a horrifying ’87-like leg down everyone seems to dread around this time of year.

A quick sudden flush, though, (like one possibly brought on by overnight futures) can be just the fuel to shake things out and take us back to SPY 280… But in the meantime, if things look scary, try not to look down. -MD

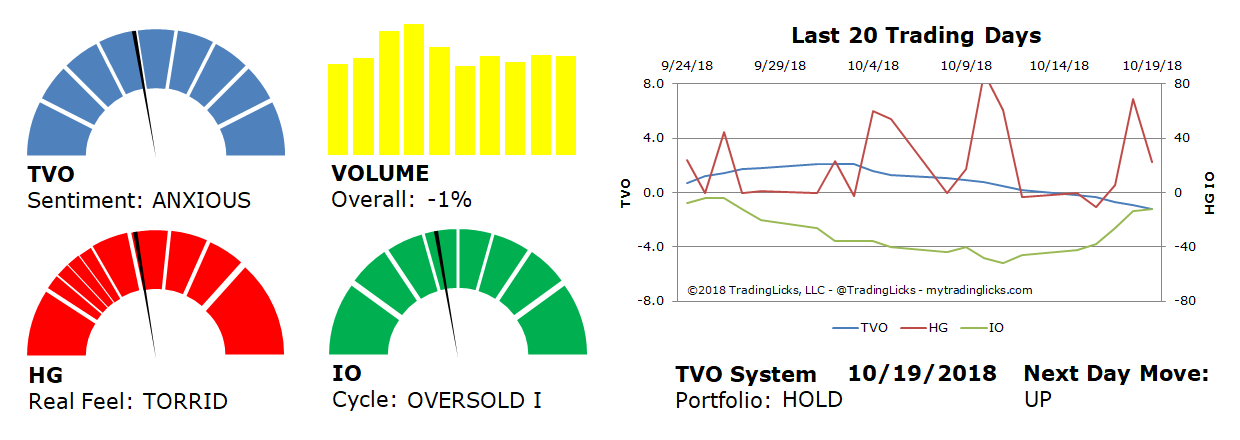

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: -1% – Today’s volume was lower than the previous session.

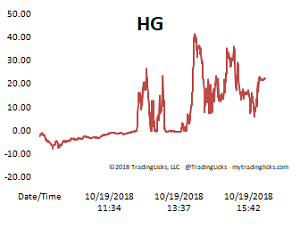

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.