TVO Market Barometer 8-09: A trillion-dollar top or picking up where we left off?

They’re saying it’s like 2000 all over again. Now that the S&P 500 is within a stones throw of all-time highs, the doomsayers have been cued to start talking about overvaluation.

And there’s no better milestone to set the tone than Apple hitting a trillion-dollar market cap. Never mind the fact that technology in general is hitting heights most of us would’ve never imagined before 2000 (Maybe those folks have forgotten life in the 90’s when we didn’t carry around pocket super computers… not a decade I’d particularly want to live over).

The human need for milestones is strong and how appropriate it would be if the market gave up the ship just before 8/22, the “technical” date when this bull market becomes the longest in history (If they want to get technical the current bull run is only 2 years old, not 9). After all, if all the ingredients of a market crash are there, why wouldn’t it happen again?

Well, when you set yourself up for history to repeat, it is almost certain that one thing will happen… something completely different.

Sure, human nature never changes, but the world we live in is a much different (and dare I say better) place than it was 10 or 20 years ago. You may be doomed to repeat the past if you don’t learn from history, but absolute conviction will convict you absolutely as a prisoner of your own fear and ultimately prevent you from moving forward.

In the volume department, the past few sessions have been split pretty much down the middle as far as advancing/declining volume. Wednesday’s end of the day sell off pushed the envelope a bit, but overall volume decreased. On Thursday, the bears made a little more progress, but still not much happened in the way of internals.

Price hasn’t done much either since we sold our SPY calls on Tuesday for a +31% gain (the 7th consecutive win for the TVO System, bringing our overall account return to +7% in 2018). And with TVO still in the “healthy market” range, the current price action is looking much more like consolidation at the highs than the terrifying trillion-dollar top that so many are desperately hoping for.

So with that in mind, folks that put all their hope (and dare I say money) in history repeating may want to consider banking on the continuing metric of a more recent market event… like this past January perhaps. -MD

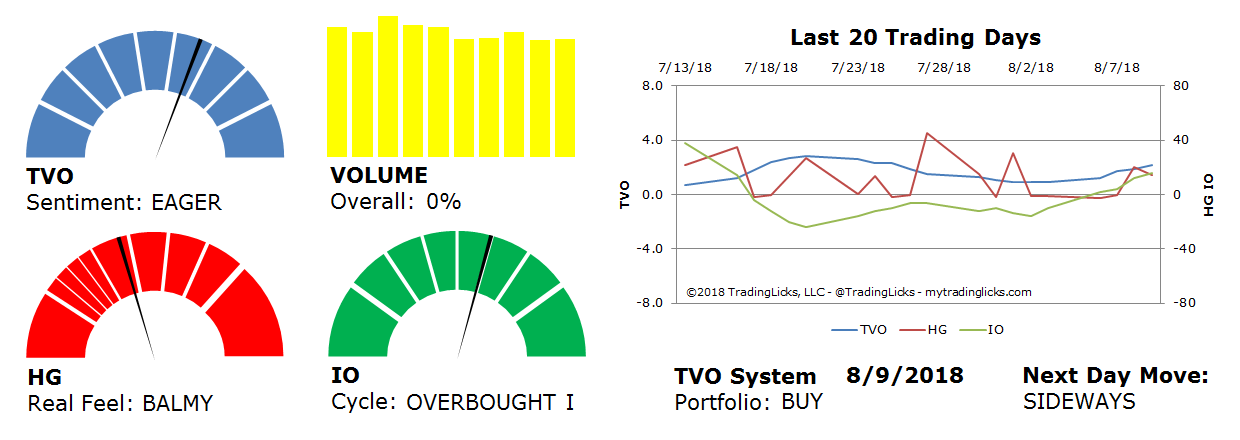

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 0% – Today’s volume was higher than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: OVERBOUGHT I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 55%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.