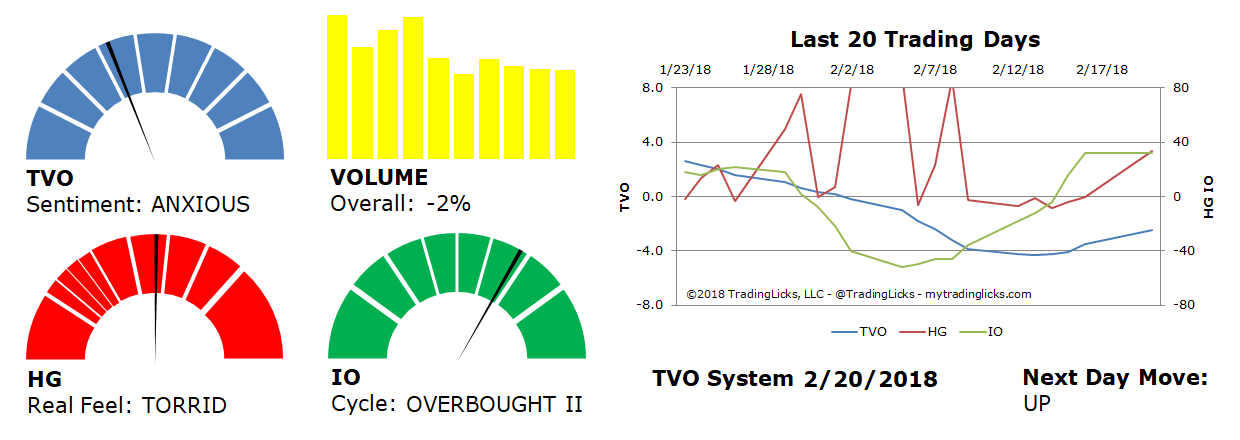

TVO Market Barometer 2-20: Will rates and inflation sink the markets?

Back from the long weekend, markets continued their run in with the 50 day MA. The indices were divided on overall sinking volume, but SPY managed to squeeze out a bit of distribution before the day was through.

As usual, the Fed minutes lie ahead and, as usual, it always seems like there’s some story that must set the scene. Today’s tale of reason for a down day is that of rising rates and the risk of inflation… a story as old as time, but still effective in scaring most folks off, at least until after Wednesday at 2pm.

But if the market is not going bond crazy, then what is really going on? From a volume standpoint, the last 6 sessions have been quite COOL or CHILLY (and one 3-DOG NIGHT) on the Heat Gauge. A pretty healthy balance of advance/decline volume, and a pretty good indication that buyers are still running the show.

A day or 2 of letting off steam at this point is not only typical, but also far more productive for long-term bulls than a straight shot back to all-time highs. How much steam we let off remains to be seen, but TVO, our longer-term volume oscillator, is moving quickly back towards zero… and where volume goes, prices will follow. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.