TVO Market Barometer 1-12: Is trading really a no-brainer?

For the first 2 weeks of the year the market has surged, breaking all kinds of records without any signs of it pulling back now or ever. So what should we do? Well, that’s a no-brainer… buy more calls.

Actually, if you decide to go with that trade, you are most likely deferring to your gut rather than your brain. As anyone who’s been at this long enough knows (in the case of Bitcoin the learning curve is a bit faster), trading from your gut will only make you sick to your stomach.

And then there are those folks who say the trades that don’t feel right are actually the good ones, so you should always do the opposite of what everyone else is doing. Well, there are a lot of defeated bears out there who practiced that theory over the last 2 weeks that now firmly disagree with that approach.

The best course of action? A well-defined system and trading plan (back and forward tested) will sometimes have you following the herd and sometimes have you going against them. With a time-tested approach, you’ll be on the right side of the market just enough (and not just when it’s going up alongside the no-brainers) to be consistently profitable for the long haul.

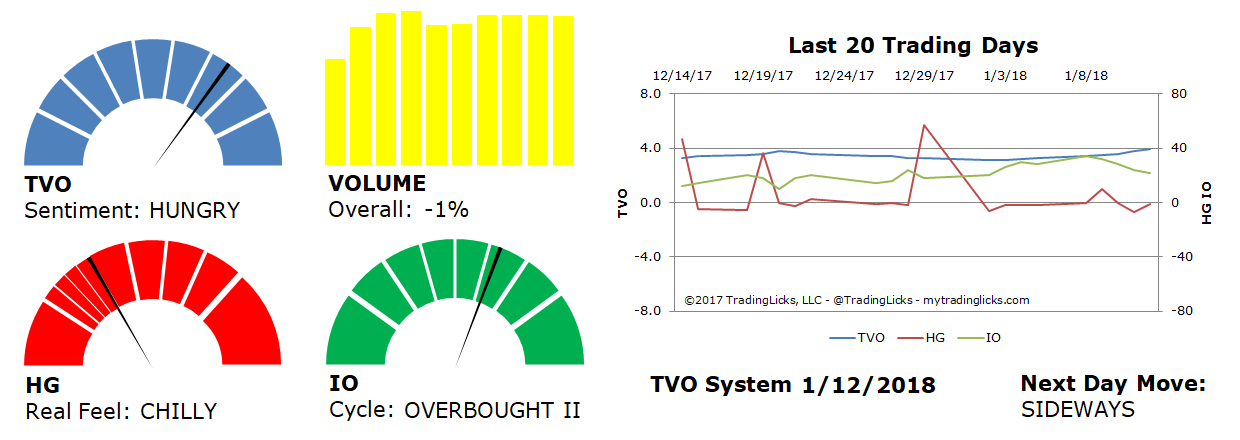

TVO, our volume oscillator, is finally just starting to climb into extreme overbought levels, but at 3.9 there is still room before we hit the top of the scale. Accumulation by big institutions is still the plan (until it isn’t), and it just may be a while before the saturation point is reached where some kind of reversal can occur.

In the meantime, when the market enters uncharted territory, there’s one thing to keep in mind while records are being broken and prices are going higher (and lower) than you can possibly imagine… behind it all, human nature (and yes, the human brains that program the machines) will always be the same… so stick to your plan. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.