TVO 2014 – The Year in Review part 1

The TVO System signals generated 6 trades in 2014 achieving an 83% win rate (5 out of 6). As a result our options account nearly doubled (73%), and no more than 10% of capital was put at risk at any given time. How did we do it? We’ll be posting an in-depth analysis of each of the trades. The first one was a short (buying puts) from exactly one year ago this week.

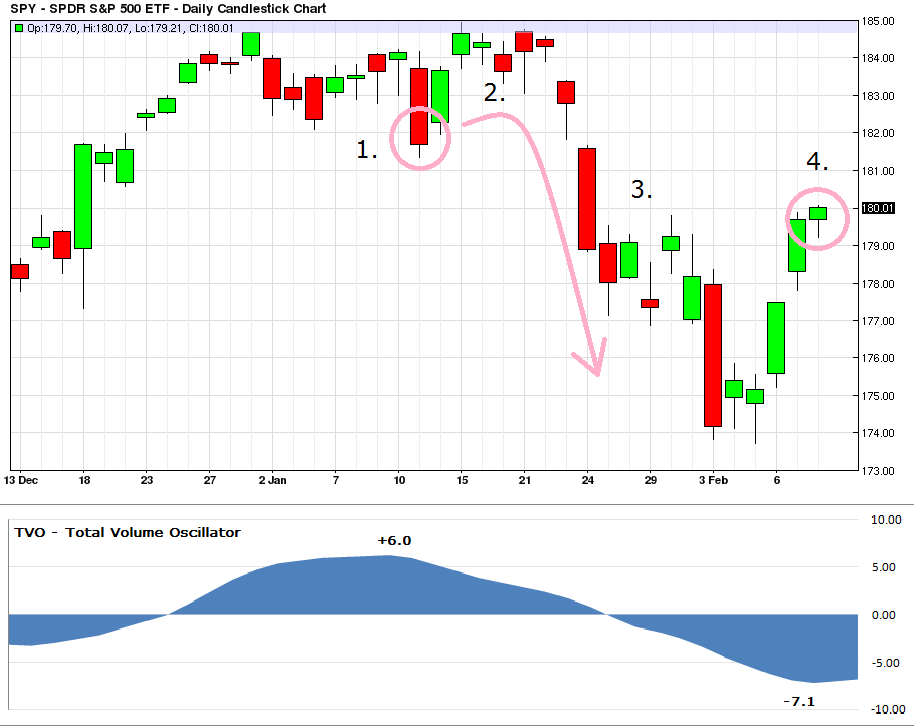

1. On Friday 1/10/14 the Oscillator reverses to +6.0 giving us a short signal. On the close Monday (1/13/14) we buy SPY Apr 14 puts at 3.38.

2. SPY proceeds toward new highs, but then quickly retreats to a tight range for the next few days.

3. TVO crosses into negative territory and on 1/24/14 the bottom gives way taking out all support levels, sweeping stops… well you know the story.

4. After a bounce in Feb that leaves the “This is the New Bear Market” folks scratching their heads, we sell our puts on 2/10/14 at 6.34. Thanks to the magic of options volatility, even though we only capture a 1% drop in SPY, the trade returns an 87% profit.

The oscillator at -7.1 gives an exit signal from the short, but it also gives us a long signal. What happens next? You can read all about that in the next post! -MD

Read about more 2014 TVO trades in Part 2 and Part 3.

For more on market volume, The TVO System, or how to trade options follow me on Twitter (@TradingLicks) and StockTwits!

Performance results on this website dated prior to September 2014 for TVO (prior to May 2015 for HG), including backtesting and trade history, are simulated. Please read our full disclaimer.