Anatomy of a TVO System trade using call options

TVO stands for Total Volume Oscillator, an indicator I developed which uses volume data to determine accumulation and distribution in the market. It’s unique in that it doesn’t use price or any other kind of data other than volume in it’s calculation. The TVO System uses oscillator values to generate signals when to go long, short or stay in cash. It’s a relatively long term system (average hold time 5 to 10 weeks) so it does take a lot of patience to execute, but the resulting gains are often worth the wait. Trading SPY options with the system can often result in gains of 50-200%.

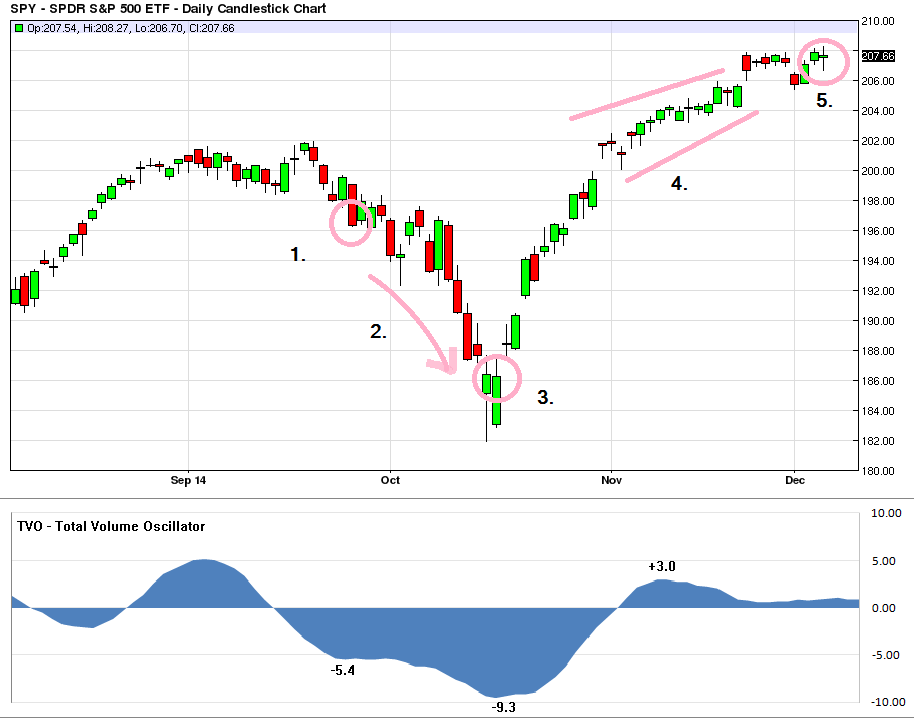

To give a better idea how it works, I’ll be posting details of all future trades. I realize that there’s so much to be learned from the winners and losers, so you’ll get to see them all. Here’s a chart of the most recent one…

1. On 9/25 the oscillator triggered a long signal at -5.4. We bought SPY Jan 15 calls at 4.77.

2. The correction took another leg down in October. Since we DO NOT use stops, we stayed in the trade.

It’s crucial to limit risk before taking a position. With options I always think of the risk as premium paid. That’s the most you could possibly lose, so you should be comfortable with that amount (usually 5-10% of capital). Then you can relax, have faith in the system and let it do the work. In fact, I went on a NH hiking vacation during that time and left the laptop at home. It was a great exercise in emotional control to say the least.

3. On 10/16 we got another long signal at -9.3 (the values have never gone below -9.9 since 1978). We added by doubling our position with more SPY Jan 15 calls (this time at 1.05, a real bargain), averaging out our cost to 2.91, while only exposing a little more capital to our overall risk.

4. During the first 2 weeks of Nov the oscillator rose to +3.0, not quite high enough to get an exit signal. We ended up holding through what turned out to be a correction of time. This is when the bears were foaming at the mouth, scoffing when I said we weren’t even close to overbought. SPY was then between 202 and 204.

5. SPY reaches 207 and we exit. When everyone becomes a bull, it might just be time to leave the party. Actually the main reason for exiting at this point was to avoid further time decay eating into the options value before expiration. We sold our SPY calls on 12/4 at 8.37 for a 187% profit.

For more on trades like these, the TVO System, or how to trade options, follow me on Twitter (@TradingLicks) and StockTwits!

Above post was an actual trade. Performance results on this website dated prior to September 2014 for TVO (prior to May 2015 for HG), including backtesting and trade history, are simulated. Please read our full disclaimer.